MODEL NOTICE U.S. Department of No. 2502-0059 INFORMED CONSUMER Housing and Urban Development (exp. 12/31/2023)

CHOICE DISCLOSURE NOTICE Office of Housing Federal Housing Commissioner

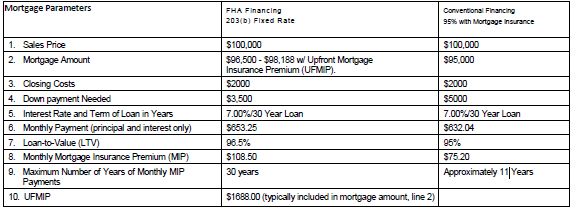

This form is provided as an example of what should be included in this disclosure. Section 203(b)(2) of the

National Housing Act requires a disclosure to assist borrowers in comparing the costs of a FHA-insured mortgage versus similar conventional mortgages. This disclosure must be given to prospective borrowers that may qualify for both FHA-insured financing and a conventional mortgage product. Public reporting burden for this disclosure is estimated to average 5 minutes per response including time for reviewing instructions, searching existing data sources, gathering and maintaining data needed and completing and reviewing the collection of information.

This agencymay not conduct or sponsor, and a person is not required to respond to a collection of information unless that collection displays a valid OMB control number.

In addition to an FHA-insured mortgage, you may also qualify for other mortgage products offered by your lender. To ensure that

you are aware of available financing options, your lender has prepared a comparison of the typical costs of alternative

conventional mortgage product(s), using representative loan amounts and costs. The loan amounts and associated costs shown

below will vary from your own mortgage loan transaction. You should study the comparison carefully, ask questions, and

determine which product is best for you. The information provided below was prepared as of [month and year].

Neither your lender nor FHA warrants that you actually qualify for any mortgage loan offered by your lender. This notice is

provided to you to identify the key differences between these mortgage products. This disclosure is not a contract and

does not constitute loan approval. Actual mortgage approval can only be made following a full underwriting analysis by

your lender.

1. The monthly MIP is calculated on the average annual principal balance, i.e., as the amount you owe on the loan

decreases each year, so does the amount of the monthly premium.

2. Based on an UFMIP rate of 1.75%, the total mortgage amount is $98,188.

3. Streamline refinances of FHA loans endorsed/insured by FHA prior to June 1, 2009 are subject to a reduced UFMIP of

.01% and a reduced annual MIP of .55% ($44.22 monthly for a loan amount of $96,500).

FHA Mortgage Insurance Premium Information

In addition to an UFMIP, you may also be charged a monthly MIP. You will pay the monthly premium for either:

· the first 30 years of the mortgage term, or the end of the mortgage term, whichever occurs first, for any mortgage

involving an original principal obligation (excluding financed UFMIP) with a LTV greater than 90 percent; or

· the first 11 years of the mortgage term, or the end of the mortgage term, whichever occurs first, if your mortgage had

an original principal obligation (excluding financed UFMIP) with a LTV ratio of less than or equal to 90 percent.

More herre: https://www.hud.gov/sites/dfiles/SFH/documents/MODELINFORMEDCONSUMER.pdf