-

- 24 JUL

Ahead of the July Fed Meeting, We look at Housing Supply

Week of July 17, 2023 in Review

Tight housing inventory continues to impact sales, home prices, and confidence among home builders. Read on for these stories and more.

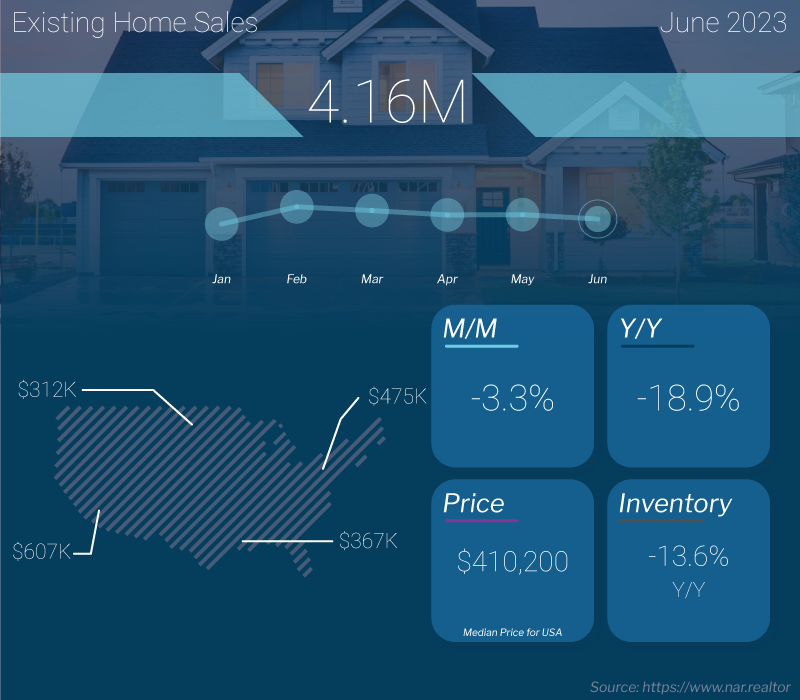

Existing Home Sales Constrained by Tight Supply

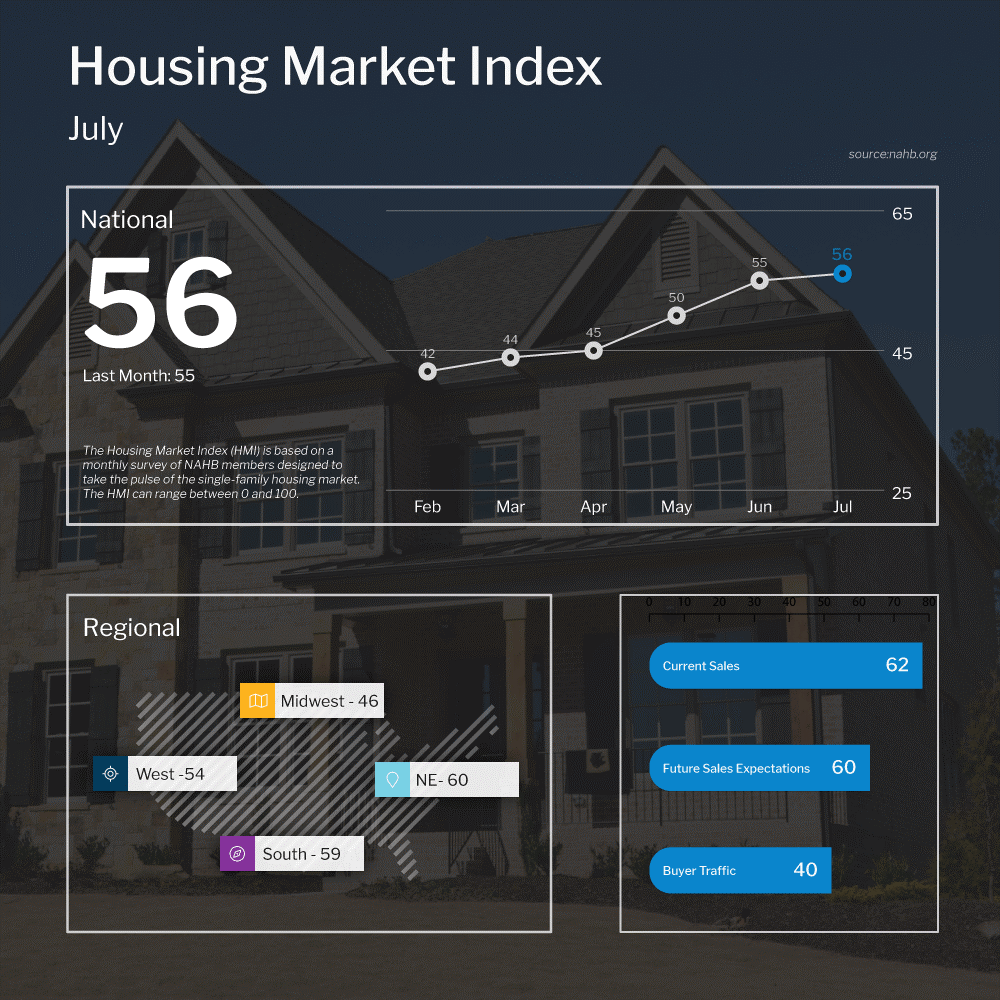

Home Builder Confidence Edged Higher This Month

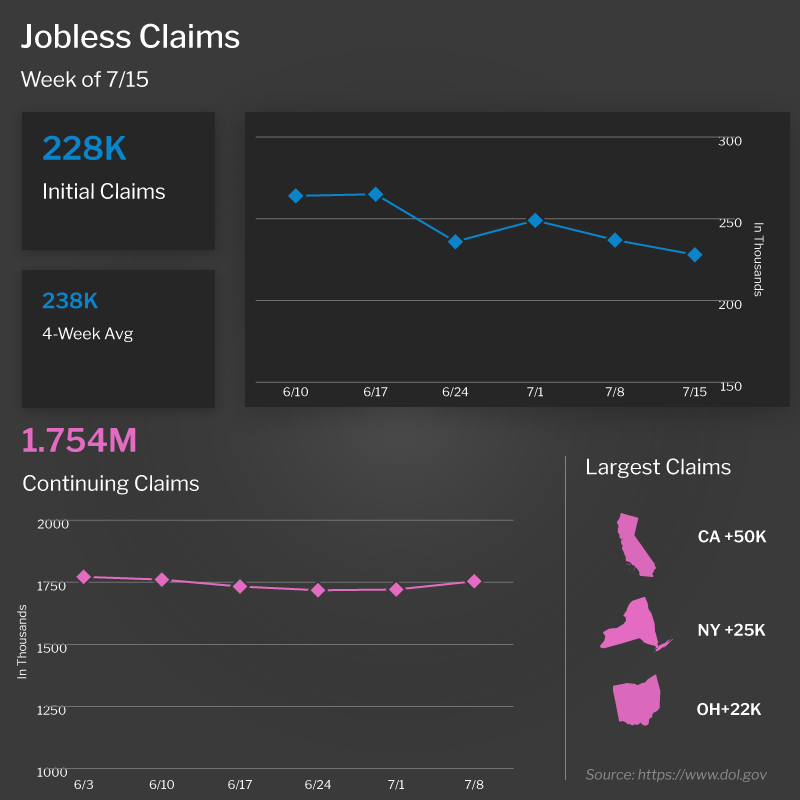

Unemployment Claims Remain Volatile

Technical Analysis. When to Consider Locking RateExisting Home Sales Constrained by Tight Supply

Existing Home Sales fell 3.3% from May to June to a 4.16-million-unit annualized pace, per the National Association of REALTORS® (NAR). Sales were also 18.9% lower than they were in June of last year. This report measures closings on existing homes, which represent around 90% of the market, making it a critical gauge for taking the pulse of the housing sector.

What’s the bottom line? Tight supply played a role in the pace of sales, per NAR’s Chief Economist Lawrence Yun, who noted that, “The first half of the year was a downer for sure with sales lower by 23%. Fewer Americans were on the move despite the usual life-changing circumstances. The pent-up demand will surely be realized soon, especially if mortgage rates and inventory move favorably.”

In fact, total existing housing inventory at the end of June equaled 1.08 million homes, well below normal with just 3.1 months’ supply available at the current sales pace. Redfin’s Housing Report for June further reiterated the tight supply we’re seeing, with active and new listings down 15% and 31% year-over-year, respectively.

Demand among buyers remains strong as evidenced by how quickly correctly priced homes are selling. Homes stayed on the market on average for 18 days last month, while 76% of homes sold in June were on the market for less than a month. By comparison, this is up from 65% back in March.Home Builder Confidence Edged Higher This Month

The National Association of Home Builders (NAHB) Housing Market Index, which measures builder confidence, rose one point to 56 in July. This latest reading marks the seventh straight increase, with builder sentiment now at the highest level since June 2022 and firmly in expansion territory over the breakeven level of 50.

What’s the bottom line? Low existing home inventory continues to boost optimism among home builders, as it is keeping the demand for new homes “solid” per the NAHB. Among the components of the index, current and future sales expectations are well in expansion territory at 62 and 60, respectively. Buyer traffic moved three points higher to 40, which is a big recovery from the low of 20 seen late last year as this gauge moves closer to the 50 breakeven level.Unemployment Claims Remain Volatile

Initial Jobless Claims fell by 9,000 in the latest week, as 228,000 people filed for unemployment benefits for the first time. Continuing Claims rose by 33,000, with 1.754 million people still receiving benefits after filing their initial claim. While this latter metric is well above the low of 1.289 million seen last September, it has declined from the high of 1.861 million reported in early April, reflecting a mix of people finding new jobs and benefits expiring.

What’s the bottom line? Initial Claims have declined to tamer numbers over the last month after topping 260,000 for the first three weeks of June. Employers are still clearly trying to retain workers.

Yet, there has also been a clear slowdown in the pace of hirings in the private sector. Last year, private sector job gains averaged 376,000 a month but we’ve seen this number decline to 215,000 a month over the last six months and 196,000 over the last three months.

What to Look for This Week

This week is full of potentially market-moving news. The Fed’s two-day meeting begins Tuesday, with their Monetary Policy Statement and press conference coming on Wednesday.

June’s reading of the Fed’s favored measure of inflation, Personal Consumption Expenditures, will also be reported on Friday.

In housing news, look for an update on home price appreciation for May when the Case-Shiller Home Price Index and the Federal Housing Finance Agency House Price Index are reported on Tuesday. June’s New and Pending Home Sales follow on Wednesday and Thursday, respectively.Technical Picture

The 10-year treasury is retesting a broken uptrend, while also finding support at important moving averages. My eye tends to go to the stochastic indicator on this chart, having reversed higher before reaching oversold. While I don’t expect much to happen until we hear from the Fed this week, this momentum indicator is suggesting to me that the market may be positioning for a more hawkish than expected Fed. If the market pushes the 10-year yield back above the green trend line shown below, we may see 4%+ on the 10-year treasury rather quickly.

While most of the mainstream commentary calls for a steady decline in inflation, and rates to follow, we are not so sure. As we pointed out over the last few weeks, the JUNE CPI print may be a short-term bottom as opposed to a sign of a continuing move lower for inflation. Base effects may start to work against us in the second half of the year, as smaller month-over-month numbers fall off beginning in July. We are of the firm belief that sailing will be anything but smooth into year's end.

Mortgage Backed Securities (MBS), which move inverse yield, are also showing concerning stochastics, as momentum is slowing before reaching above overbought, as price runs into resistance at the 25-day moving average.

What’s the bottom line? The market is near complete consensus in its expectations of another .25bps Fed rate hike at the conclusion of their 2-day meeting this week. That rate hike is already “priced-in” to the market. We are waiting to hear directly from the Fed and ascertain not only what is said but the tone of its delivery. We are concerned that markets have declared inflation “over” and any developments to contradict this assumption may be a shock to the market and cause knee-jerk reactions in price and yield.

Once again, as we have said throughout the year, if you are looking to time your rate locks, look to the 10-year treasury for guidance. As yield approaches 3.7% consider that an opportunity, with our trading range well defined as 3.7% - 4.05%

* Specific loan program availability and requirements may vary. Please get in touch with your mortgage advisor for more information.