-

- 07 AUG

This weeks CPI Report is Everything

Week of July 31, 2023 in Review

The BLS Jobs Report.

Leisure and Hospitality Continues to Boost Private Payrolls

Initial Jobless Claims Remain Tame

Impact of Work from Anywhere on Job Openings

Tight Supply Adding Pricing Pressure to HousingWhere Are Job Gains Really Coming From?

The Bureau of Labor Statistics (BLS) reported that there were 187,000 jobs created in July, which was slightly weaker than estimates. Job growth in May and June was also revised lower, subtracting 49,000 jobs in those months combined. The unemployment rate fell from 3.6% to 3.5%.

What’s the bottom line? Job gains appear to be slowing somewhat, as job growth in June (185,000) and July (187,000) were the two lowest levels reported since December 2020. Plus, a deeper look at the data shows that part-time workers increased by 972,000, although a large portion of part-time workers indicated that they did not return to the workforce for “economic reasons”. Full-time workers fell by 585,000.

Average weekly hours also declined slightly, which is important because one of the ways businesses cut costs is to cut the number of hours worked. This caused average weekly earnings, which is a good reflection of take-home pay, to only increase 0.1% from June. However, average hourly earnings have yet to show weakness.

The latest BLS jobs report appears to be right down the middle. While job growth is moderating, unemployment remains low, hourly wages are not falling, and there is still an elevated number of job openings. All signs of a tight, resilient labor market.Leisure and Hospitality Continues to Boost Private Payrolls

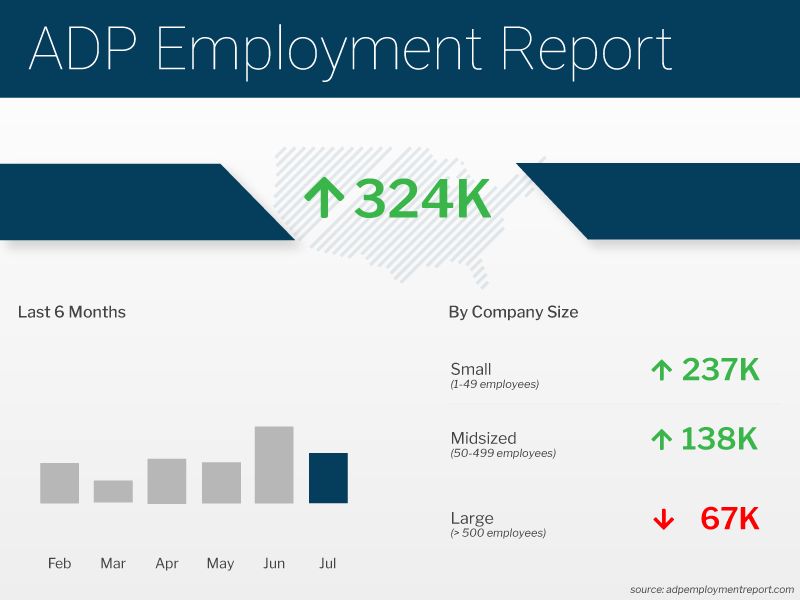

The ADP Employment Report showed that private payrolls were much stronger than expected in July, with 324,000 jobs created. Annual pay for job stayers increased 6.2% and job changers saw an average increase of 10.2%. While these pay gains are still high, they have been moderating over the last year.

Leisure and hospitality once again led the way with 201,000 job gains (more than quadruple any other sector), while manufacturing was a weak spot, shedding jobs for the fifth straight month. This correlated with July’s ISM Index, as their survey of purchasing and supply executives nationwide showed a “slowdown in hiring, with attrition, freezes and layoffs actively in place.”

What’s the bottom line? While we have seen some discrepancies between the BLS and ADP Employment Reports in recent months, the takeaway from both reports remains the same. The job market remains strong. Perhaps more strong than most expected, including the Fed. We are looking forward to seeing how Q4 evolves, including holiday hiring. We don’t anticipate any major change to the employment story in the coming months.

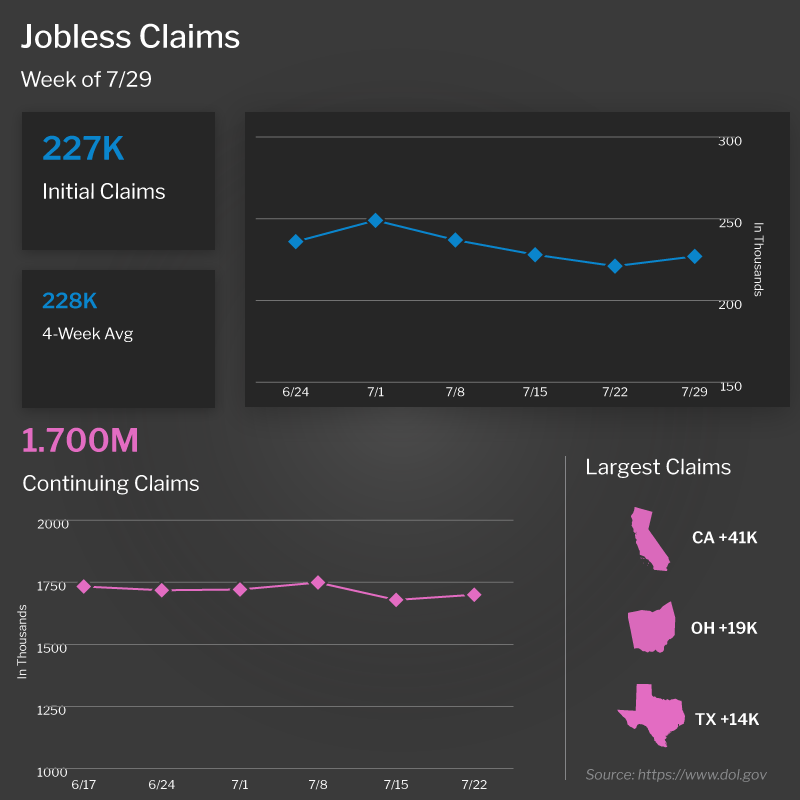

Initial Jobless Claims Remain Tame

Initial Jobless Claims rose by 6,000 in the latest week, as 227,000 people filed for unemployment benefits for the first time. While this number can be volatile from week to week, first-time filers have remained under 230,000 for the last three weeks after topping 260,000 in the first three weeks of June. This tamer level of Initial Claims shows that employers are still clearly trying to retain their workers.

Meanwhile, Continuing Claims rose by 21,000, with 1.7 million people still receiving benefits after filing their initial claim. While this latter metric is well above the low of 1.289 million seen last September, it has declined from the high of 1.861 million reported in early April, reflecting a mix of people finding new jobs and benefits expiring.Impact of Work from Anywhere on Job Openings

The latest Job Openings and Labor Turnover Survey (JOLTS) showed that job openings declined from 9.62 million in May to 9.58 million in June, as they continue to trend lower since peaking in March 2022. Note that job openings are still elevated compared to pre-Covid levels.

As work from anywhere became more common during Covid, the frequency of seeing the same job listing posted in multiple states has increased. This has added a new dynamic to the JOLTS data and is certainly a factor in the larger number of openings that we are now seeing when compared to before the pandemic.

What to Look for This Week

Crucial inflation reports are ahead, starting with June’s Consumer Price Index on Thursday. Look for the Producer Price Index on Friday, which will give us news on wholesale inflation.

The latest Jobless Claims will be reported as usual on Thursday. Investors will also be closely watching Wednesday’s 10-year Note and Thursday’s 30-year Bond auctions for the level of demand.Technical Picture

The 10-year broke above the key level of 4.10% last week. We would expect yield to retest that level, which is what we have seen over the past two days. 10-year yield is in a clearly defined bullish channel, with a series of higher highs and higher lows. While we could move a little lower from here, we believe risk is to the upside. As we have said for weeks, base effects are going to work against us for the remainder of the year. July’s CPI report will produce the first headwind, as we drop a 0.0% headline CPI number from July 2022, and add a new number for July 2023, presumably greater than 0. This effect will be a headwind for the remaining months of 2023. July’s CPI report will be released Thursday before market open. We are very cautious of this event as we see an easy path for 10-year yield to move to the upper-end of the channel. We think it’s possible to see 4.3% - 4.4% 10-year yield in the next several days. This would push mortgage rates to 7.5%+, if it were to occur.

Mortgage Backed Securities (MBS), which move inverse to mortgage rate, are forming lower highs and lower lows, in a clear downtrend. We believe that the headwinds described above, in addition to other macro-economic forces coming into play will keep pressure on MBS. Barring some unforeseen event, we expect MBS to face constant headwind well into 2024.

What’s the bottom line? EVERYTHING this week depends on how much greater than 0.0% the headline CPI prints. If we happen to get a headline CPI print of .04%, rates will worsen quickly and significantly, however if headline is .01% - .02% it may not be too bad. Although, we fully expect 10-year yield to remain in the channel highlighted above. Recent increases in the cost of oil and food commodities may be enough to produce an upside surprise. The question mark for us is shelter. If shelter doesn’t show meaningful declines month over month, a hot headline CPI number becomes more probable. For the entirety of the year we have said the trading range of the 10-year has been 3.7% - 4.1%. After breaking above 4.1% last week, and retesting Friday and Today, closing Monday at 4.07%, we fear a hot CPI report may push rates above 4.1% and establish a new, higher range. Perhaps 4.1% - 4.4%. It’s too early to tell, but risk is clearly to the upside this week. We have a rate locking bias.

* Specific loan program availability and requirements may vary. Please get in touch with your mortgage advisor for more information.