-

Week of September 11, 2023 in Review

Key inflation data was reported ahead of this week’s Fed meeting. Here are the latest stories:

What “Fueled” the Rise in Consumer Inflation?

New High in Home Price Appreciation

Important Context Regarding Tame Jobless Claims

Technical Analysis of Rate Markets Suggests A Critical Juncture

What “Fueled” the Rise in Consumer Inflation?

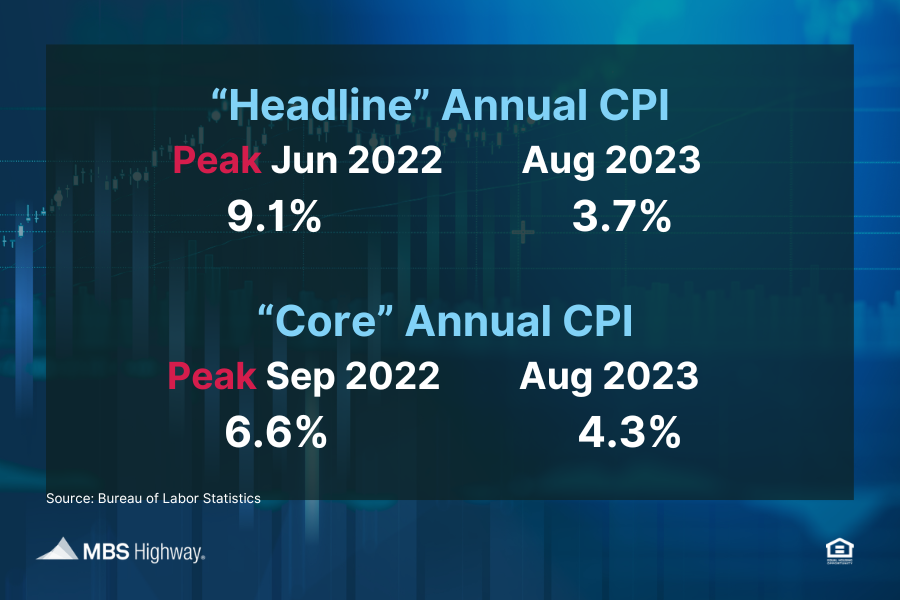

August’s Consumer Price Index (CPI) showed that inflation rose 0.6%, with this monthly reading coming slightly higher than estimates. On an annual basis, CPI increased from 3.2% to 3.7% last month. Core CPI, which strips out volatile food and energy prices, increased 0.3% while the annual reading declined from 4.7% to 4.3%. Surging energy and gasoline prices accounted for much of the monthly increase, while tame food and shelter prices and declining costs for used cars helped inflation last month. Note that if the United Auto Workers strike ends up having a prolonged impact on the supply of new cars, we could see used car prices start to rise again.

What’s the bottom line? While annual inflation did move higher, this notch higher is partly due to a lower figure from last August, which was removed from the rolling 12-month calculation and replaced with last month’s 0.6% reading. These are the base effects we have talked about for several weeks, and are now starting to be a factor. Base effects will continue to be a headwind for annualized inflation for the next few months. ”

New High in Home Price Appreciation

CoreLogic’s Home Price Index showed that home prices nationwide rose for the six straight month, up 0.4% from June to July. Prices were also 2.5% higher when compared to July of last year. CoreLogic forecasts that home prices will rise 0.4% in August and 3.5% in the year going forward, though their forecasts tend to be on the conservative side historically.

Zillow also reported that home values have increased 4.5% since the beginning of this year, with their index showing new all-time highs in home values month after month since May. Zillow’s index is on pace for 7% appreciation this year, based on the monthly gains we’ve seen to date.

What’s the bottom line? The latest rise in home prices reported by CoreLogic and Zillow echoes the strong growth seen by Case-Shiller, Black Knight and the Federal Housing Finance Agency.Important Context Regarding Tame Jobless Claims

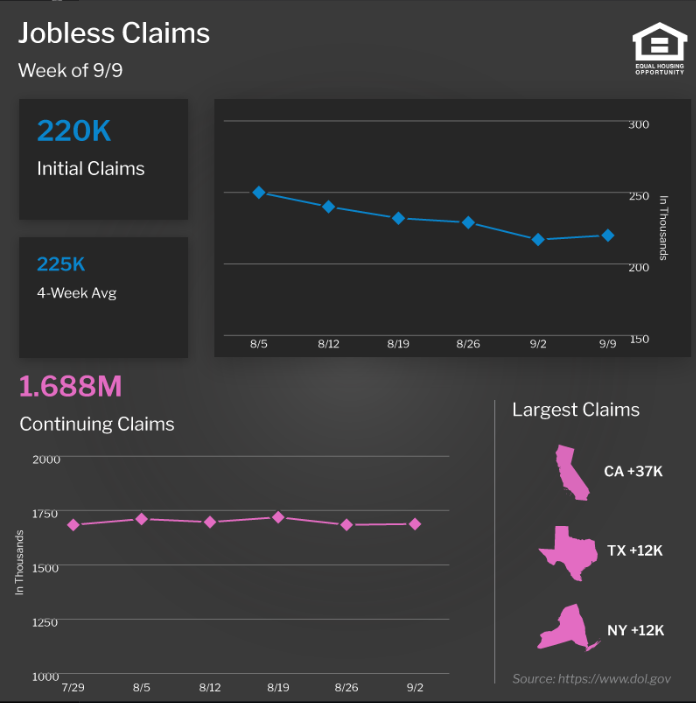

Initial Jobless Claims rose by 3,000 in the latest week, with 220,000 people filing for unemployment benefits for the first time. Continuing Claims also increased by 4,000, with 1.688 million people still receiving benefits after filing their initial claim. This latter number has been trending lower since topping 1.861 million in early April, reflecting a mix of people finding new jobs and benefits expiring.

What’s the bottom line? While the tame level of Initial Jobless Claims suggests a strong labor market, the measured week included the Labor Day holiday, so the shortened filing time may have impacted the data.

It will be important to see if a sustained rise in Initial Jobless Claims follows in the coming months, especially with the Fed looking for clear signs that the labor market is softening as they consider further rate hikes this fall.

What to Look for This Week

Important housing reports are ahead, starting Monday with an update on home builder sentiment for this month from the National Association of Home Builders. August’s Housing Starts and Building Permits will be reported on Tuesday, while Existing Home Sales follow on Thursday.

Also on Thursday, look for the latest Jobless Claims and September’s manufacturing data for the Philadelphia region.

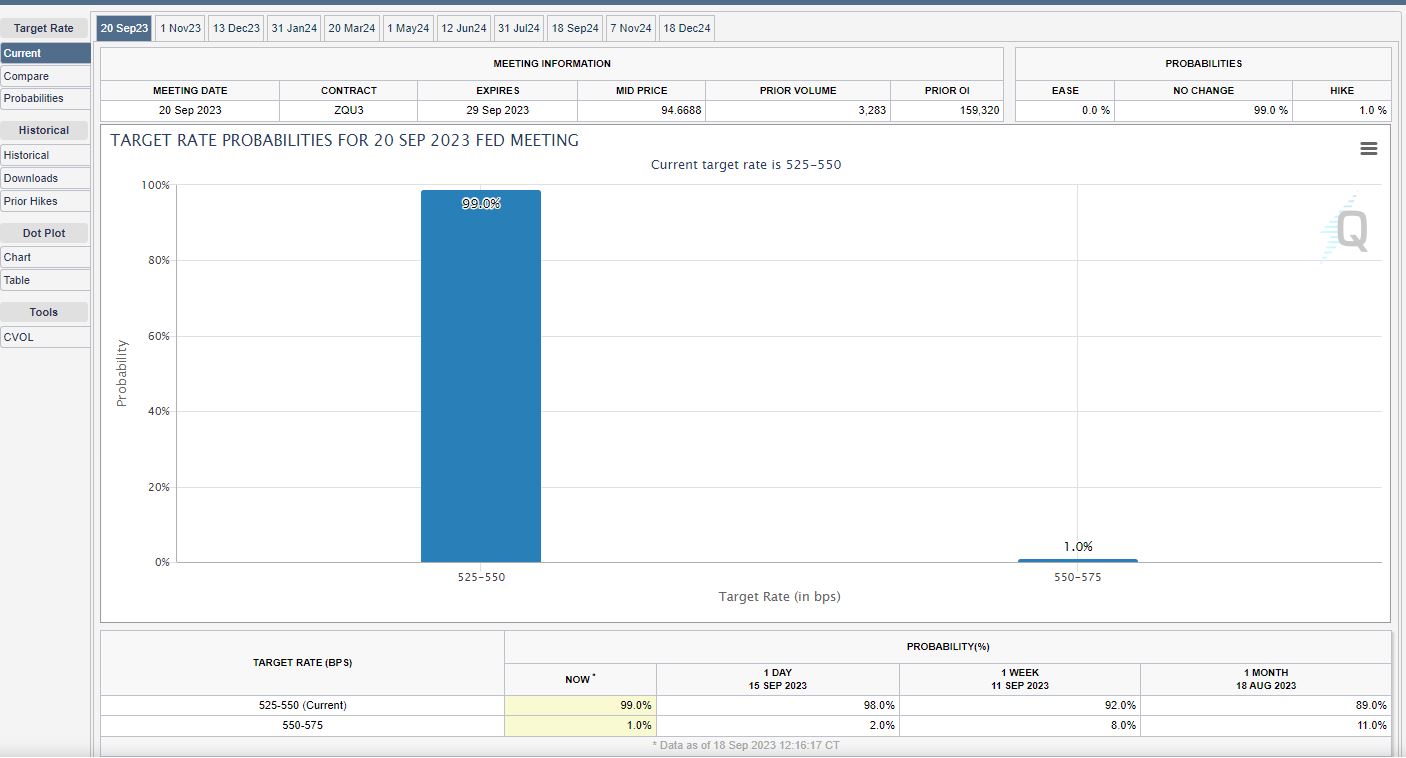

But the Fed will likely steal the show as their two-day meeting begins Tuesday, with their Monetary Policy Statement, rate decision and press conference coming on Wednesday. Currently markets are NOT expecting the Fed to hike this week.

Technical Picture

Yield on the 10-year treasury started the week higher, back at a crucial resistance level of 4.3%. This is the third time we have tested this level as support. Should yields make a sustained move higher, it could be the beginning of a move just above 5%. In that scenario, mortgage rates would undoubtedly move into the 8’s. This is not a prediction, but an observation to underscore the importance that current levels ahead of this week’s Federal Reserve meeting. The CME Groups “Fed Watch” tool indicates a 99% probability the fed keeps the Fed Funds Rate unchanged.

Mortgage Bonds (MBS) are also approaching important levels. Remember, MBS price is inverse to yield. A lower price (as charted) represents higher yield. MBS a clearly in a downtrend, achieving lower highs and lower lows. While we may some short periods of relief, I wouldn’t expect a sustained and long-term improvement in mortgage rates until we see MBS achieve a higher high, and higher low. I am less optimistic that mortgage rates will improve anytime in 2023 or the first part of 2024, because the technical are telling me as much.

What’s the bottom line?

There are several risks to the economy and rates ahead. We will be paying attention to what the Fed says later this week and the way they say it, we are also paying attention to the risks. The ongoing UAW strike, could eventually put some upward pressure on inflation, energy prices continue to pressure inflation, an annual adjustment to the way healthcare is accounted for is likely to also put upward pressure on inflation. We are also quite aware that there is a real possibility of a government shut-down the first week of October as it appears the US House of Representatives is increasingly dysfunctional.

As we noted above, it is crucially important that none of these things push the yield on the 10-yr treasury above 4.3%. Such a move would likely turn into a leg higher in interest rates, which would see the average mortgage rate move into the 8’s. * Specific loan program availability and requirements may vary. Please get in touch with your mortgage advisor for more information.