-

- 04 DEC

Recent Rate Rally Running Out Of Steam?

There was welcome news for consumers as inflation continued to inch lower in October. Plus, tight housing inventory is still hindering contract signings and boosting home values. Here are last week’s headlines:

Inflation Inching Lower

Pending Home Sales Plunge in October

Home Values Still Standing Strong

Continuing Jobless Claims Hit 2-Year HighInflation Inching Lower

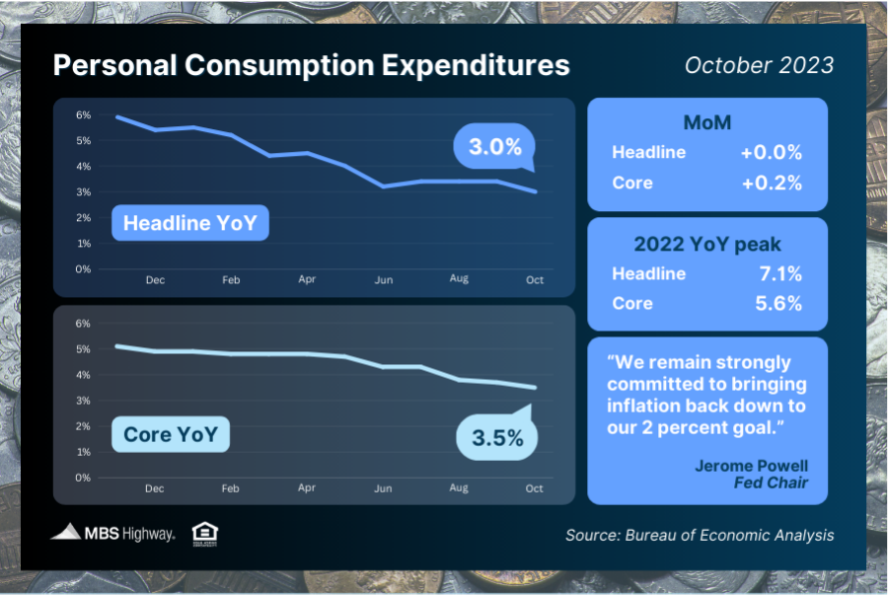

October’s Personal Consumption Expenditures (PCE) showed that headline inflation was flat for the month, with the year-over-year reading falling from 3.4% to 3%. Core PCE, the Fed’s preferred method which strips out volatile food and energy prices, rose by 0.2% in October. The year-over-year reading fell from 3.7% to 3.5% – the lowest level in more than two years.

What’s the bottom line? Inflation has made significant progress lower after peaking last year, with the headline reading at 3% (down from 7.1%) and the core reading at 3.5% (down from 5.6%). Plus, annualizing the last six months’ worth of readings puts Core PCE at 2.4%, which is even closer to the Fed’s 2% target. Many economists believe this progress lower is enough for the Fed to pause rate hikes once again at their next meeting. We’ll find out for sure on Wednesday, December 13.

Pending Home Sales Plunge in October

Pending Home Sales fell 1.5% from September to October, reaching the lowest level since the National Association of REALTORS® began tracking them in 2001. This data measures signed contracts on existing homes, making it a forward-looking indicator for closings as measured by Existing Home Sales.

What’s the bottom line? Elevated mortgage rates certainly caused many buyers to press pause on the home search this fall, but tight inventory remains a key challenge as well. NAR’s Chief Economist, Lawrence Yun, noted that “limited housing inventory is significantly preventing housing demand from fully being satisfied.” He added, “It is vital that we continue to focus on boosting housing supply by all means in all corners of the country over the coming months."Home Values Still Standing Strong

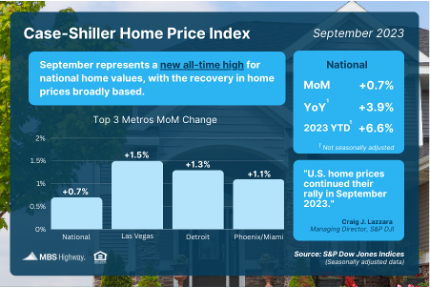

The Case-Shiller Home Price Index, showed home prices nationwide rose 0.7% from August to September after seasonal adjustment, marking the eighth consecutive month of gains. The Federal Housing Finance Agency’s (FHFA) House Price Index also saw home prices rise 0.6% in September, with their index setting new record highs in home prices every month since February.

Note that FHFA’s report measures home price appreciation on single-family homes with conforming loan amounts, which means it most likely represents lower-priced homes. FHFA also does not include cash buyers or jumbo loans, and these factors account for some of the differences in the two reports.

What’s the bottom line? Home values have hit new all-time highs according to Case-Shiller, FHFA, CoreLogic, Black Knight and Zillow, more than recovering from the downturn we saw in the second half of 2022. Prices are now on pace to appreciate between 6-8% this year depending on the index, based on the reported pace of appreciation through September.

Continuing Jobless Claims Hit 2-Year High

Initial Jobless Claims rose by 7,000 in the latest week, with 218,000 people filing for unemployment benefits for the first time. The real story is Continuing Claims, which increased 86,000, showing that 1.927 million people are still receiving benefits after filing their initial claim. This is the first time Continuing Claims have topped 1.9 million in two years.

What’s the bottom line? Initial Jobless Claims remain relatively low on a historical basis, suggesting that employers are trying to hold on to workers. Yet, Continuing Claims have risen by 269,000 since September. This higher trend speaks to a weakening labor market, where it’s becoming harder for people to find employment once they are let go.

What to Look for This Week

More housing appreciation data is ahead when CoreLogic’s Home Price Index for October is released on Tuesday.

Then labor sector reports will dominate the headlines, starting Tuesday with job openings via the JOLTS report for October. Look for November’s ADP Employment Report (which measures private payrolls) on Wednesday and the latest Jobless Claims on Thursday. Friday brings November’s Jobs Report from the Bureau of Labor Statistics, which includes Non-farm Payrolls and the Unemployment Rate.

Technical Picture

In recent weeks interest rates, and mortgage rates, have improved significantly from their late summer highs. Interest rates are not partying alone, equity markets have experienced one of their best Novembers on record. Both are likely a result of markets attempting to front-run the Federal Reserve into rate cuts in the first half of 2024. Since the beginning of the current hiking cycle, the market has attempted such front-running on six previous occasions, each of the previous occasions was met with a surge of hawkish commentary from the Fed. The evidence leads me to assume a seventh such occasion is set to unfold at the December 12-13 Federal Reserve FOMC Committee meeting.

Read my complete technical analysis and my “Locking/Floating” Position at my Substack.

* Specific loan program availability and requirements may vary. Please get in touch with your mortgage advisor for more information.