-

Week of October 9, 2023 in Review

Shelter and energy costs pushed consumer prices higher in September, but inflation has made significant progress lower since peaking last year. Here are last week’s headlines:

Lodging, Energy Costs Push Inflation Higher

Wholesale Inflation Heating Up

Understanding Seasonal Housing and Appreciation Trends

Interest Rates Move Towards September Highs.

Lodging, Energy Costs Push Inflation Higher

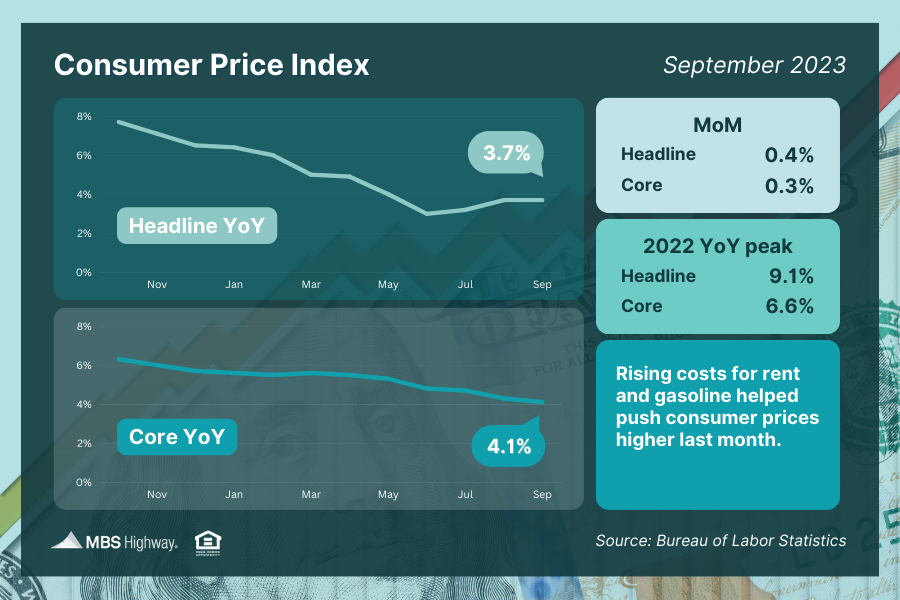

September’s Consumer Price Index (CPI) showed that inflation rose 0.4%, with this monthly reading coming in just above estimates. On an annual basis, CPI held steady at 3.7% last month, though this is still near the lowest level in more than two years. Core CPI, which strips out volatile food and energy prices, increased 0.3% while the annual reading declined from 4.3% to 4.1%.

Rising shelter, energy and gasoline prices helped push inflation higher last month. However, oil prices have fallen since the end of September, which should help inflation moving forward if they don’t spike higher again.

What’s the bottom line? Inflation has made significant progress lower after peaking last year, with the headline reading at 3.7% (down from 9.1%) and the core reading at 4.1% (down from 6.6%). Remember, the Fed has been hiking its benchmark Fed Funds Rate (which is the overnight borrowing rate for banks) to try to slow the economy and curb inflation. While it’s widely believed the Fed is near the end of the hiking cycle, the question remains whether or not one more hike is still to come. The feds next FOMC meeting begins November 1 meeting?

Wholesale Inflation Heating Up

The Producer Price Index (PPI), which measures inflation on the wholesale level, increased by 0.5% in September, coming in hotter than expected. On an annual basis, PPI rose from 2% to 2.2% though there was a big revision to the previous report, bringing the annual figure up from 1.6% to 2%.

Core PPI, which also strips out volatile food and energy prices, rose by 0.3%, with the year-over-year reading increasing from 2.5% to 2.7%.

What’s the bottom line? While annual PPI moved higher, it remains well below last year’s 11.7% peak. Plus, much of the increase in wholesale inflation was also due to rising energy prices, which were up 3.3% last month after rising 10.3% in August.

Understanding Seasonal Housing and Appreciation Trends

Zillow reported that home values declined by 0.1% in September, the first monthly decrease since February, though prices are still 2.1% higher than in September of last year. In addition, home values are still on pace to increase 6% this year according to Zillow’s index.

What’s the bottom line? The small price decline in September follows significant increases seen throughout the spring and summer months, including a 1.3% rise in April, May and June and a 0.7% rise in July. Fall usually brings less competition in the housing market because families with school-age children like to be settled ahead of a new school year. This season is typically the softest for home price appreciation.

What to Look for This Week

Key housing reports are ahead, starting Tuesday with an update on home builder sentiment for this month from the National Association of Home Builders. September’s Housing Starts and Building Permits will be reported on Wednesday, while Existing Home Sales follow on Thursday.

Also, look for October’s manufacturing data for the New York and Philadelphia regions on Monday and Thursday, respectively. September’s Retail Sales will be released on Tuesday and the latest Jobless Claims on Thursday.

Technical Picture

After pulling back from 4.8%, the 10-year treasury yield has held its uptrend. As long as this trend is maintained, I wouldn’t be surprised to see a retest of 4.8%. What we will be watching for is whether or not a new high yield is achieved on the next run-up.

As you might suspect, after some improvement last week, mortgage backed securities (MBS) are have reversed to move lower. The move lower in MBS price is pushing mortgage rates higher once again. Much like the 10-year, I suspect we will retest previous lows, from there a more clear picture will likely emerge.

What’s the bottom line? The current trajectory suggests interest rates want to retest levels set last month. As long as the Fed maintains their “Higher for Longer” narrative, and markets believe the narrative expect rates to stay elevated, and possibly move higher. The outlier to watch for is any escalation in geopolitical conflict. An escalation that takes the market by surprise will trigger a reallocation of money into the US treasury market and rates could fall quickly. It’s hard to play for an outlier event like this, but one you must be aware of.

* Specific loan program availability and requirements may vary. Please get in touch with your mortgage advisor for more information.