-

- 21 AUG

Interest Rates Reach 2007 Levels. What's Next?

Week of August 14, 2023 in Review

The Fed’s July meeting provided some hints about what’s next for rate hikes. Here are the latest headlines:

Understanding the Decline in Home Builder Confidence.

Are More Fed Rate Hikes Ahead?

Initial Jobless Claims Remain Tame.

What an Important Recession Indicator Is Saying.

Technical Picture: Are both higher AND lower mortgage rates ahead?Understanding the Decline in Home Builder Confidence

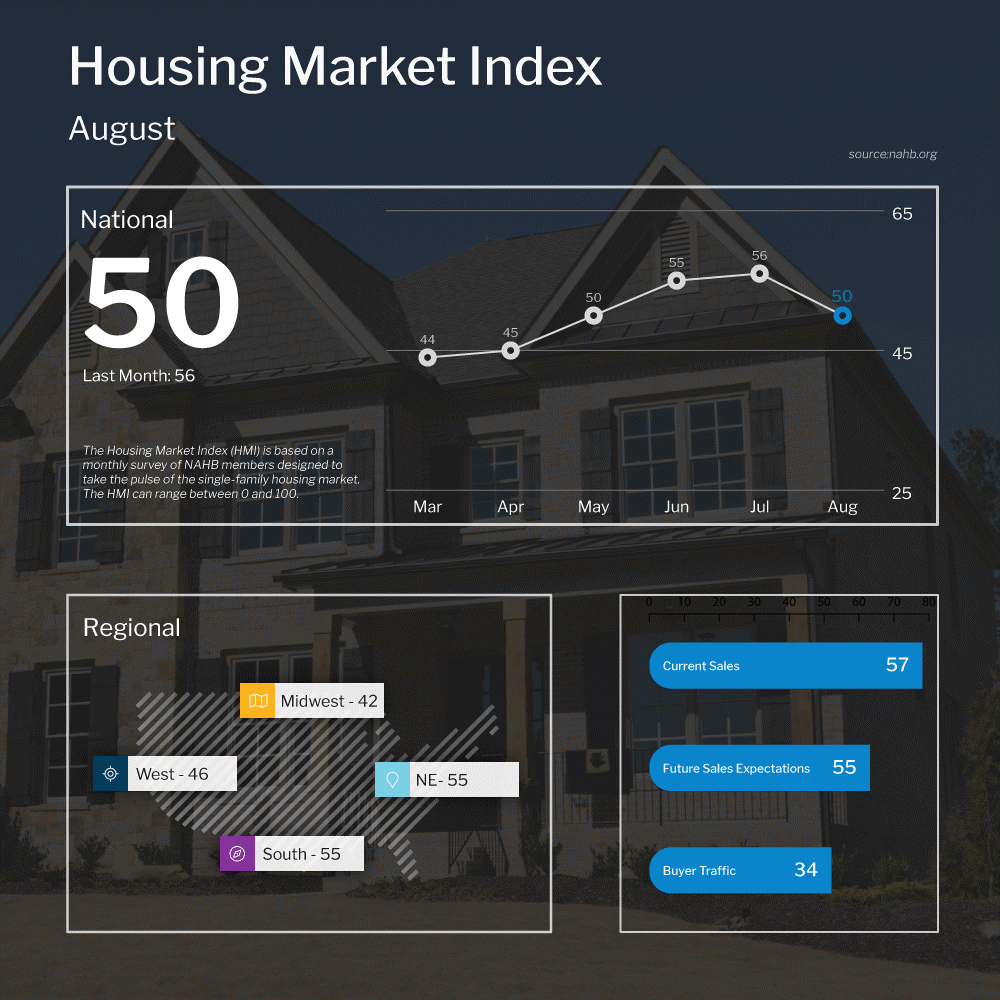

The National Association of Home Builders (NAHB) Housing Market Index, which measures builder confidence, fell six points to 50 in August. However, this latest reading follows seven consecutive monthly increases and confidence remains right at the breakeven level between expansion and contraction.

What’s the bottom line? The NAHB cited several reasons for the decline in sentiment this month, including rising mortgage rates, high construction costs stemming from a lack of workers, a shortage of buildable lots, and ongoing shortages of distribution transformers (which are crucial for converting voltage in transformer lines to appropriate household levels).

Are More Fed Rate Hikes Ahead?

The minutes from the Fed’s July meeting showed that the Fed no longer believes that our economy will enter a recession, but they do see downside risks to growth. The Fed also believes there are upside risks to inflation, as the minutes showed they are not yet sure they have won the battle on inflation and more rate hikes may be ahead.

What’s the bottom line? Remember, the Fed has been hiking its benchmark Fed Funds Rate (which is the overnight borrowing rate for banks) to try to slow the economy and curb inflation. July’s hike of 25 basis points was their eleventh since March of last year.

All eyes are now turned to September 20, which is when the Fed’s next rate decision will be announced. Inflation, labor sector and other economic data released in the coming weeks will play a key role in this decision. The minutes did show that the Fed feels the labor market needs a “balancing of demand and supply.” In other words, they may want to see weaker headline job figures before calling it quits on rate hikes.Initial Jobless Claims Remain Tame

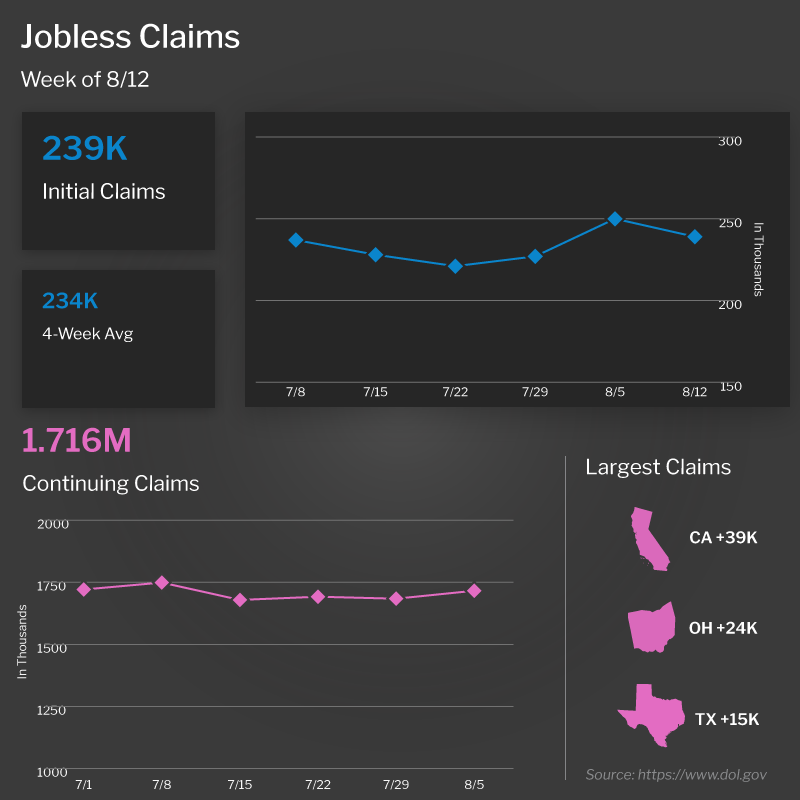

One area of the labor sector still not showing sustained weakness is unemployment claims. The number of first-time filers fell by 11,000, with 239,000 Initial Jobless Claims reported in the latest week. Initial Claims have remained relatively tame after topping 260,000 for the first three weeks of June. which suggests that employers are trying to retain their workers. This trend coincides with recent reporting that many businesses are struggling to find qualified workers for their positions.

Meanwhile, Continuing Claims rose by 32,000, with 1.716 million people still receiving benefits after filing their initial claim. This number has been trending lower since topping 1.861 million in early April, reflecting a mix of people finding new jobs and benefits expiring.

What’s the bottom line? Employment in the U.S. remains tight. With the Fed focused on employment data, this was an important real-time report because it includes the sample week that the Bureau of Labor Statistics will use in the modeling for their job growth estimates. Again, the Fed will be closely analyzing this headline job growth figure when August’s Jobs Report is released on September 1.What an Important Recession Indicator Is Saying

The Conference Board reported that Leading Economic Indicators (LEI) fell 0.4% in July, which is the sixteenth consecutive month of declines. The LEI tracks where the economy is heading, and it “continues to suggest that economic activity is likely to decelerate and descend into mild contraction in the months ahead,” explained Justyna Zabinska-La Monica, Senior Manager, Business Cycle Indicators.

What’s the bottom line? Despite the Fed’s belief that we can avoid a recession, the Conference Board is standing by their forecast that our economy will enter “a short and shallow recession in the Q4 2023 to Q1 2024 timespan.” Yield curve inversions, near-record-high credit card debt, and the lag effect of the Fed’s rate hikes are additional reasons why a recession may not be off the table just yet.

While a recession is not a great thing forthe economy, one positive aspect is that periods of recession are always coupled with lower interest rates.

What to Look for This Week

More housing data is ahead, as July’s Existing and New Home Sales will be reported on Tuesday and Wednesday, respectively. Look for the latest Jobless Claims figures as usual on Thursday.

Investors will also be watching closely as economists, central bankers and policymakers from around the world join the Fed for its Jackson Hole Economic Symposium, which starts on Thursday, with Jerome Powell scheduled to speak on Friday. In the past, this event has served as a forum for the Fed to shed light on how they are thinking about policy moving forward.

Technical Picture

There is a lot of attention on the 10-year treasury lately, for good reason. The 10-year closed Monday above the important level of 4.33%, which was the high set last October. We will be waiting to see where the 10-year treasury ends the week. A weekly close above this level will be bearish for rates. However, a close back below 4.33% could signal a false breakout, which often leads to quick reversals, in this case, it would lead to yields dropping fairly quickly. It’s too early to tell at this point. How the week closes will be crucial. Don’t forget the Fed is speaking from Jackson Hole Friday, which will be a catalyst, up or down is the question. Why is this level so important? Using technical analysis, we can determine an expectation of a successful break out of a previously established range. In this case, a successful breakout could lead 10-year yield as high as 5.4%. If the breakout fails, roughly 4% would be the first level of support to expect as the price falls to the trend line.

Mortgage Backed Securities (MBS) are also flirting with lows from last fall. Remember, MBS charts are expressed as price, which is inverse yield. A lower price means a higher yield. MBS has become very disconnected from the moving averages. You can see the 25-day moving average is far above the current price at 97. At some point, the price will reconnect with moving averages. Either price will rise, or moving averages will fall. In cases like this, it’s usually a bit of both. Also, you’ll notice the stochastic (momentum indicator) is currently very oversold. Both of these things suggest a bounce may be coming, which will lead to lower mortgage rates. Whether or not it will be a sustained bounce I cannot say, we’ll evaluate that as it unfolds. We believe both short-term lower rates and longer-term higher rates are possible, in fact, that’s our expectation at this point.

What’s the bottom line? While we have joined the “Higher for Longer” camp, we also understand that these things never move in a straight line. For that reason, we expect treasury yield and mortgage rates to ease a bit in the short term. While the bounce likely won’t be extreme, it may be an opportunity to lock a mortgage rate closer to 7% than we currently have. Ultimately, we believe rates will trend higher through the end of the year and into Q1 next year.

* Specific loan program availability and requirements may vary. Please get in touch with your mortgage advisor for more information.