-

Week of April 8, 2024 in Review

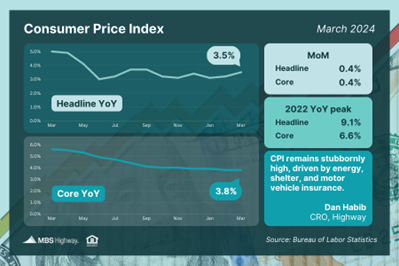

Inflation has improved significantly after peaking in 2022, but recent hotter than expected readings have stalled the progress lower. Here are last week’s headlines:

- Inflation Progress Stalls

- Wholesale Inflation Better Than Feared

- Continuing Unemployment Claims Top 1.8 Million

- Latest on Small Business Optimism…Or Lack Thereof

The latest Consumer Price Index (CPI) showed higher than expected inflation in March, with the headline reading up 0.4% from February. On an annual basis, CPI moved in the wrong direction, rising from 3.2% to 3.5%. The Core measure, which strips out volatile food and energy prices, increased 0.4% while that annual reading remained at 3.8% (though it was expected to decline to 3.7%).

What’s the bottom line? March’s hotter than expected consumer inflation report continues a trend we’ve seen in recent months, as rising energy and shelter costs have added to pricing pressure.

Price stability is part of the Fed’s dual mandate. When inflation became rampant a few years ago, the Fed began aggressively hiking their benchmark Fed Funds Rate (the overnight borrowing rate for banks) to slow the economy and rein in inflation. While inflation has fallen considerably after peaking in 2022, the progress lower has slowed, which could delay the Fed’s timing for rate cuts this year.

Wholesale Inflation Better Than Feared

The Producer Price Index (PPI), which measures inflation on the wholesale level, rose 0.2% in March, just below estimates. On an annual basis, PPI rose from 1.6% to 2.1%, but this was better than the 2.2% estimate. Core PPI, which strips out volatile food and energy prices, was in line with forecasts at a 0.2% rise. The year-over-year reading rose from 2% to 2.4%, just above forecasts.

What’s the bottom line? Overall, the monthly PPI readings were tame and better than feared, which was a relief after the hot CPI readings that were reported the previous day. Plus, some of the PPI components are factored into another important consumer inflation measure called Personal Consumption Expenditures (PCE), which is the Fed’s favored measure, and this could potentially lead to a slightly better PCE report when that data is released on April 26.

Continuing Unemployment Claims Top 1.8 Million

Initial Jobless Claims fell by 11,000 in the latest week, retreating from a two-month high, as 211,000 people filed for unemployment benefits for the first time. However, Continuing Claims surged higher by 28,000, with 1.817 million people still receiving benefits after filing their initial claim.

What’s the bottom line? Initial Jobless Claims can be volatile from week to week, but their relatively low level suggests that employers are still trying to hold on to theirLatest on Small Business Optimism…or Lack Thereof

The National Federation of Independent Business (NFIB) Small Business Optimism Index fell to 88.5 in March. This is the weakest reading since December 2012 as “owners continue to manage numerous economic headwinds,” per Chief Economist Bill Dunkelberg.

What’s the bottom line? The NFIB noted that inflation is back on top as the biggest problem small businesses are facing, as owners are likely feeling the impact of higher oil prices and the stalling progress on reducing pricing pressure. Plans to hire also fell for the fourth straight month. Despite talk of a strong economy, small businesses are still feeling pessimistic.

What to Look for This Week (4/15/2024)

We’ll kick off the week Monday with an update on home builder sentiment for this month. Tuesday brings news on March’s Housing Starts and Building Permits, while Existing Home Sales data follows on Thursday.

We’ll also get an update on March’s Retail Sales and the latest manufacturing data for the New York region on Monday. Jobless Claims and manufacturing for Philadelphia will be reported Thursday.