-

- 06 NOV

Week of October 30, 2023 in Review

Jobs Numbers: One Month Is Not a Trend

Continuing Jobless Claims Reach 6-Month High

Is the Fed Done with Rate Hikes?

Home Prices Hitting Highs

Rates Tagging Technically Important Levels

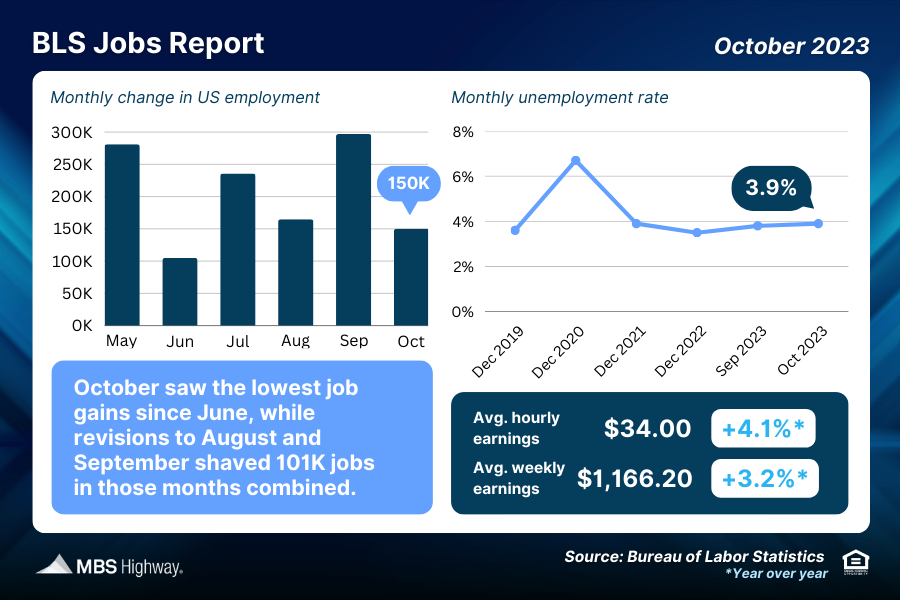

The Latest Employment Numbers

The Bureau of Labor Statistics (BLS) reported that there were 150,000 jobs created in October versus the 180,000 forecasted. Revisions to August and September also shaved 101,000 jobs in those months combined. However, the three-month average is still 200,000 monthly job creations.

The unemployment rate rose from 3.8% to 3.9%.

What’s the bottom line? There are two reports within the Jobs Report and there is a fundamental difference between them. The Business Survey is where the headline job number comes from, and it's based predominately on modeling and estimations.

The Household Survey, where the Unemployment Rate comes from, is considered more real-time because it’s derived by calling households to see if they are employed.

Continuing Jobless Claims Reach 6-Month High

Initial Jobless Claims rose by 5,000 in the latest week, with 217,000 people filing for unemployment benefits for the first time. The real story is Continuing Claims, which increased by 35,000, showing that 1.82 million people are still receiving benefits after filing their initial claim. The last time Continuing Claims were this high was back in April.

What’s the bottom line? While Initial Jobless Claims remain relatively low, they have increased for the last two weeks, with the latest data reaching highs not seen since early September. Continuing Claims have also risen for seven straight weeks. Overall, the data shows that employers are trying to hold on to workers, but it’s becoming harder for people to find employment once they are let go.

Is the Fed Done with Rate Hikes?

After eleven rate hikes since March of last year, the Fed left their benchmark Federal Funds Rate unchanged at a range of 5.25% to 5.5% at their meeting last Wednesday, just like they did in September. The Fed Funds Rate is the interest rate for overnight borrowing for banks and it is not the same as mortgage rates. When the Fed hikes the Fed Funds Rate, they are trying to slow the economy and curb inflation.

What’s the bottom line? The Fed’s decision to pause rate hikes for the second straight meeting was unanimous. However, Fed Chair Jerome Powell did leave the door open for another rate hike at their next meeting on December 13. The strength of the labor sector remains a key factor in their decision, with the Fed looking for clear signs that the labor market is softening as they consider further rate hikes.

Also this week, Treasury Secretary, Janet Yellen released the quarterly road map to fund our country. She plans to concentrate her debt issuance on the front end of the curve, providing some relief to longer-term debt, like the 10-year treasury. The market took this news and shaved 50bps off the 10-year treasury, which is working against the job of the Fed. So, while the Fed has been saying recently that “The bond market is doing some of the work for them”, Ms. Yellen seems to want to unwind some of that “work” the Fed has been touting.

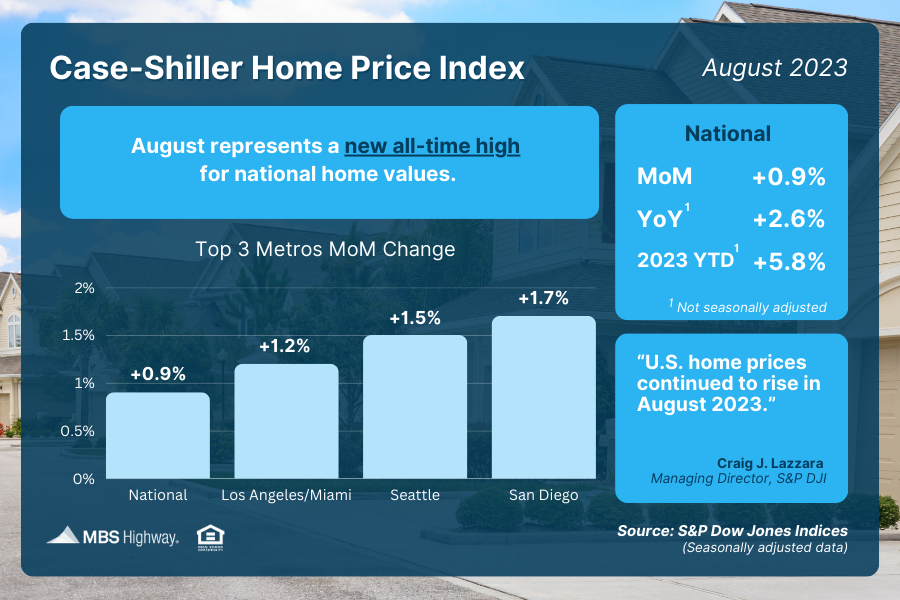

Home Prices Hitting Highs

The Case-Shiller Home Price Index, which is considered the “gold standard” for appreciation, showed home prices nationwide rose 0.9% from July to August after seasonal adjustment, marking the seventh consecutive month of gains. The Federal Housing Finance Agency’s (FHFA) House Price Index also saw home prices rise 0.6% in August, with their index reporting gains every month so far this year.

What’s the bottom line? Home values have hit new all-time highs according to Case-Shiller, FHFA, CoreLogic, Black Knight and Zillow, more than recovering from the downturn we saw in the second half of 2022. This year, prices are on pace to appreciate between 6-8% depending on the index, based on the reported pace of appreciation through August.

What to Look for This Week

The economic calendar is quiet, but we will see more housing appreciation data when CoreLogic’s Home Price Index for September is released on Tuesday. The latest Jobless Claims data will also be reported on Thursday.

Investors will also be closely watching Wednesday’s 10-year Note and Thursday’s 30-year Bond auctions for the level of demand.Technical Picture

The 10-year treasury enjoyed impressive price improvements last week, pushing yields lower. However, let’s not get too excited quite yet. Yields have only returned to lows of late September, where there is important support in the form of an uptrend that began in May of 2023. These moves very rarely happen in a short line. I expect some back and forth. The 10-year treasury yield may trade as low as 4.3%, to fill the open gap below, but I would treat that as strong support. The 10-year may also trade back up, above 5% is we see that inflation isn’t continuing to cool.

On 10/25, I tweeted that a negative divergence had formed on the 10-year treasury yield, and a pullback may be a short-term probability, but we are far from out of the woods. Sure enough, that pullback came two days later. Follow me @AaronMontell

What’s the bottom line? As the Fed was telling us the bond market was doing some of the work for them, Treasury Secretary Janet Yellen was busy sending bond yields on a coffee break by putting downward pressure on the long end of the yield curve. We’ll be curious to see how this evolves in the coming weeks. We are also quite anxious to see the October inflation figures, via the next CPI release, scheduled for 11/14. We are aware of an annual healthcare cost adjustment to the CPI report which will show up in the next release and will put upward pressure on the headline number. That’s expected, but if there’s a surprise, it has the potential to make a move to the upside appear larger than it may be, and the market will react quickly.

* Specific loan program availability and requirements may vary. Please get in touch with your mortgage advisor for more information.