-

Week of September 25, 2023 in Review

Inflation continues to show signs of improvement:

Inflation Makes Progress Lower

Pending Home Sales Tumble in August

New Home Sales Hit Slowest Pace Since March

Record High for Home Prices

Interest Rates Push Higher

Inflation Makes Progress Lower

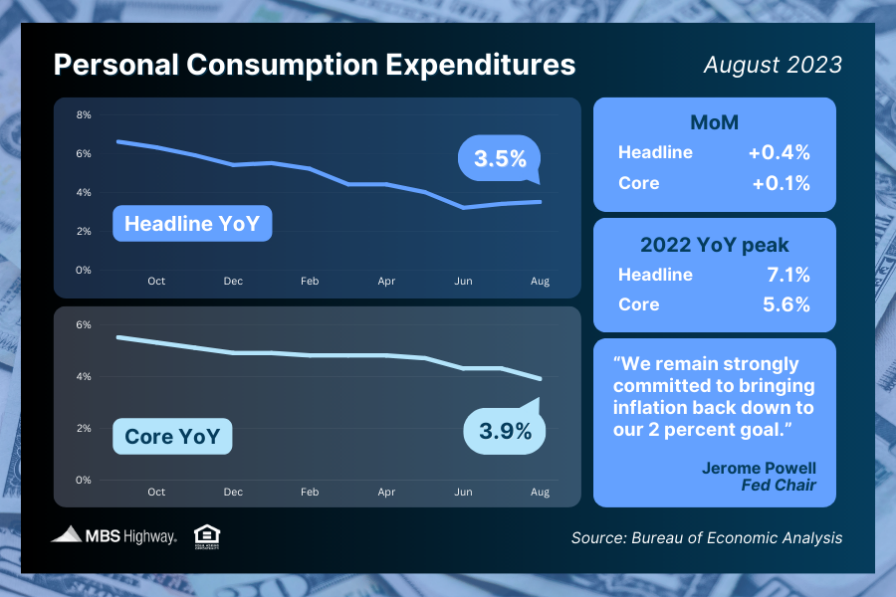

August’s Personal Consumption Expenditures (PCE) showed that headline inflation increased by a lower-than-expected 0.4%. The year-over-year reading rose from 3.4% to 3.5%, though the increase was due to revisions in prior reporting. Core PCE, the Fed’s preferred method which strips out volatile food and energy prices, rose by 0.1% in August with the year-over-year reading falling from 4.3% to 3.9.

What’s the bottom line? The Fed has hiked its benchmark Fed Funds Rate (the overnight borrowing rate for banks) eleven times since March of last year to try to slow the economy and curb inflation. While inflation is still elevated, it has made a big improvement from the 7.1% peak seen last year and is now less than half that amount at 3.5% on the headline reading. Will this progress be enough for the Fed to pause further rate hikes? We’ll find out at their next meeting on November 1.

Pending Home Sales Tumble in August

Pending Home Sales fell 7.1% from July to August, with sales also 18.7% below the level seen a year earlier. This data measures signed contracts on existing homes, making it a forward-looking indicator for closings as measured by Existing Home Sales. August’s level of signed contracts suggests that closings in September will likely come in at an annualized pace under 4 million.

What’s the bottom line? Some would-be homebuyers have pressed pause on their purchase due to high rates and low inventory. Lawrence Yun, chief economist for the National Association of REALTORS® (NAR), explained, "It's clear that increased housing inventory and better interest rates are essential to revive the housing market.”New Home Sales Hit Slowest Pace Since March

New Home Sales, which measure signed contracts on new homes, fell 8.7% from July to August to a 675,000-unit annualized pace. However, there was a positive revision to the number of signed contracts in July, and sales are still higher than they were a year earlier.

What’s the bottom line? Buyers continue to turn to the new construction market due to the lack of existing homes for sale.

The tight supply of both existing and new homes will continue to be supportive of home prices. On that note, the median sales price for new homes was $430,300, which was down from $440,300 a year ago. While this may sound like home prices are declining, this figure is not the same as appreciation but represents the mid-price and can be skewed by the mix of sales among lower-priced and higher-priced homes.

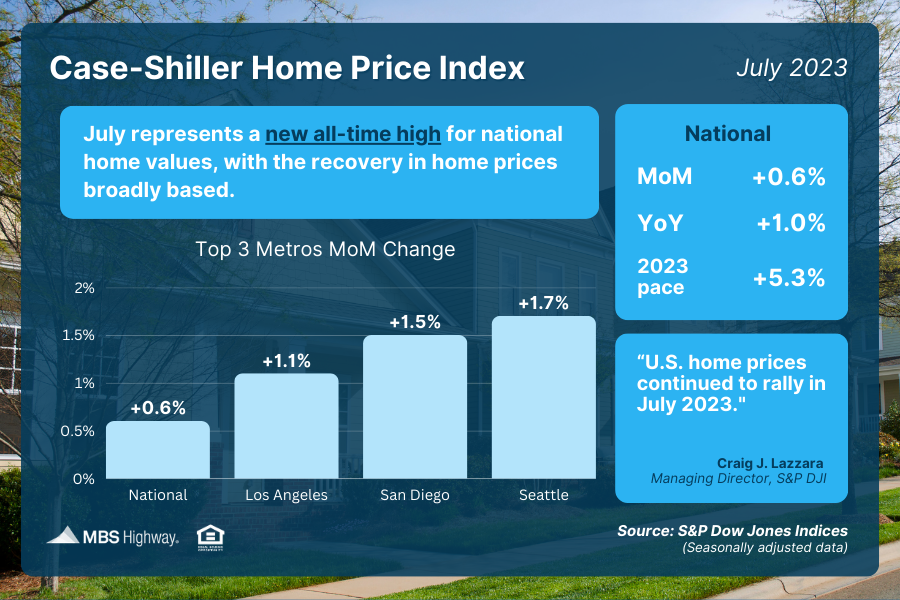

Record High for Home Prices

The Case-Shiller Home Price Index, which is considered the “gold standard” for appreciation, showed home prices nationwide rose 0.6% from June to July after seasonal adjustment, marking the sixth consecutive month of gains. The Federal Housing Finance Agency’s (FHFA) House Price Index also saw home prices rise 0.8% in July, with their index reporting gains every month so far this year.

Note that FHFA’s report measures home price appreciation on single-family homes with conforming loan amounts, which means it most likely represents lower-priced homes. FHFA also does not include cash buyers or jumbo loans, and these factors account for some of the differences in the two reports.

What’s the bottom line? Home values have hit new all-time highs according to Case-Shiller, FHFA, CoreLogic, Black Knight and Zillow, more than recovering from the downturn we saw in the second half of 2022. This year, prices are on pace to appreciate between 5-9% depending on the index, based on the reported pace of appreciation through July.

What to Look for This Week

Look for important updates on the labor sector starting Tuesday with news on job openings via the JOLTS report for August. Wednesday brings ADP’s Employment Report for September, which measures private payrolls, while the latest Jobless Claims will be reported on Thursday. The biggest headline comes Friday with September’s Jobs Report from the Bureau of Labor Statistics, which includes Non-farm Payrolls and the Unemployment Rate.

Technical Picture

The 10-year Treasury Yield has broken convincingly above the 4.3% level, which had served as resistance. It’s looking more likely that 10-year Treasury yield wants to retest the 2007 highs around 5.3%. This would push mortgage rates towards the mid 8’s.

However, I suspect yields will first fall to re-test 4.3% before turning and heading to 5%. There is also a pssability that yields breakdown, and fall below 4.3%, however, I belive it to be more likely rates touch 4.3% and move higher from there.

The US Dollar (USD) has been a reliable directional indicator. As the US Dollar marches higher, yields follow. I’ll be watching the USD to move lower ahead of yields.

Mortgage Backed Securities (MBS) are testing cycle lows. Remember, MBS are inverse to yield. Lower MBS price equals higher mortgage rates. If the 10-year Treasury Yield moves lower to retest 4.3%, MBS in turn will move higher and likely retest the overhead trend line shown below in green. This will likely present a short-term opportunity for locking in a mortgage rate.

What’s the bottom line? The market is finally getting the “Higher for Longer” message. So far, the market appears to be receiving the message like an adult, without a temper-tantrum…So far. I suppose it depends on how high yields rise, at some point the market will break down like a two-year old who can’t find their favorite blanket, but we’re not there yet! In the meantime, I suspect yields and USD will retrace lower to retest the levels from which they recently broke out. Depending upon the circumstance that retest occurs, I’ll likely suggest clients to capture that opportunity to lock in a mortgage rate on any active contracts.

* Specific loan program availability and requirements may vary. Please get in touch with your mortgage advisor for more information.