-

- 15 AUG

July CPI Cools, Yet Mortgage Rates Rise.

Week of August 7, 2023 in Review

Crucial inflation data sparked volatility in the markets, while another home price index report shows new all-time highs. Read on for these stories and more:

Is Consumer Inflation Rearing Its Head Again?

Wholesale Inflation Hotter Than Expected

Home Price Appreciation Heading Higher

Is the Rise in Initial Jobless Claims a New Trend?Is Consumer Inflation Rearing Its Head Again?

July’s Consumer Price Index (CPI) showed that inflation rose 0.2%, with this monthly reading coming in just below estimates. On an annual basis, however, CPI increased from 3% to 3.2% last month, though this is still near the lowest level in more than two years. Core CPI, which strips out volatile food and energy prices, increased by 0.2% while the annual reading declined from 4.8% to 4.7%.

Declining costs for used cars and airfares helped inflation last month, as did moderate readings for shelter, gasoline, and food.

What’s the bottom line? While annual inflation did move higher month over month, this notch higher is partly due to base effects now working against falling inflation. Inflation has made significant progress lower after peaking at 9.1% in June 2022. Easing inflation is welcome news as it signifies a break from price increases for some goods and services. However, there are some components of CPI that have been trending higher over the past several months, including energy and food costs. Also, an annual adjustment to healthcare costs is likely to provide a headwind for CPI later this fall. We remained concerned that inflation may be bottoming before heading higher again.Wholesale Inflation Hotter Than Expected

The Producer Price Index (PPI), which measures inflation on the wholesale level, increased by 0.3% in July, coming in just above expectations. On an annual basis, PPI rose from 0.2% to 0.8%. Core PPI, which also strips out volatile food and energy prices, rose by 0.3%, with the year-over-year reading remaining at 2.4%.

What’s the bottom line? While the annual PPI also moved higher, it was coming from a very low level and remains extremely muted, well below last year’s 11.7% peak.

The Fed will be closely watching upcoming CPI and PPI readings for August (releasing September 13 and 14) and their favored inflation report Personal Consumption Expenditures (July’s data releases August 31) as they weigh this decision.Home Price Appreciation Heading Higher

Black Knight’s Home Price Index hit an all-time high in June, with “nearly every major market experiencing month-over-month growth.” Home prices rose 0.7% in June and they are now up 0.8% on an annual basis, with appreciation at 2.9% through the first six months of this year. At this pace, prices are on track to appreciate 5.8% in 2023.

What’s the bottom line? The latest rise in home prices reported by Black Knight mirrors the strong growth that’s also been noted by Case-Shiller, CoreLogic, Zillow, and the Federal Housing Finance Agency in their respective indexes.Is the Rise in Initial Jobless Claims a New Trend?

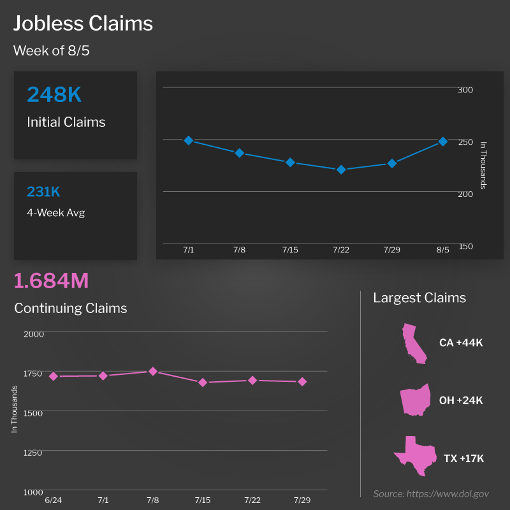

below 230,000 for three straight weeks, Initial Jobless Claims rose by 21,000, as 248,000 people filed for unemployment benefits for the first time. Continuing Claims fell by 8,000, with 1.684 million people still receiving benefits after filing their initial claim. This latter metric has been on a downward trend from the high of 1.861 million reported in early April, reflecting a mix of people finding new jobs and benefits expiring.

What’s the bottom line? Initial Jobless Claims have remained relatively low of late. While slightly above recent claims, one week does not make a trend. Data in the coming weeks may confirm a higher trend, or prove it to once again be a short-lived anomaly in a tight labor market.What to Look for This Week

Important housing reports are ahead, starting Tuesday with an update on home builder sentiment for this month from the National Association of Home Builders. July’s Housing Starts and Building Permits follow on Wednesday.

July’s Retail Sales will be released on Tuesday and the latest Jobless Claims on Thursday.

Plus, the minutes from the Fed’s July meeting will be released on Wednesday and these always have the potential to add volatility to the markets.

Further in the future, we are watching for a potential government shutdown at the end of September if lawmakers fail to pass a budget. Some fear that if a government shutdown were to occur, it could be lengthy given the dysfunction in Washington.

We are also following the U.A.W. labor negotiations, as a U.A.W. strike could have an impact on employment and inflation via new autos.Technical Picture

The 10-year ended last week above support at 4.09%, above the March 2023 highs. We are now in danger of reaching a new multi-year high yield for the 10-year treasury above 4.33%. In technical analysis, the pattern below, known as an ascending triangle carries a high probability of continuation. In other words, a high probability of new highs to come. In fact, IF yield were to break above the previous high, technical analysis suggests a move to 5.35% is very possible. Yikes!

Mortgage Bonds (MBS) ended last week on lows and extended those losses Monday. Mortgage rates are testing the highest points in more than 20 years, achieved last October. If, and that’s a big if, the 10-year yield does push higher as described above, mortgage rates could rise to levels not seen in nearly 25 years.

What’s the bottom line? If there is one takeaway from this week’s update, it should be that we have arrived at an important inflection point in the fight against inflation. The data coming in the next two months is crucial to what the first part of 2024 may look like.

If inflation remains sticky, or worse, shows a 70s-style resurgence, the 10-year treasury could yield more than 5%, and mortgage rates could top 8%. On the other hand, if our concerns of inflation bottoming are unfounded, and inflation continues we would like to see some relief in treasury yields on mortgage rates.

If Washington can’t get out of its own way and ends up in a shutdown, that may challenge the feds' “soft Landing” and provide downward pressure on yields, depending on the length of the shutdown.

In short, given the uncertainty of the moment, and the recent strength in treasury yields, we have a rate-locking bias this week. * Specific loan program availability and requirements may vary. Please get in touch with your mortgage advisor for more information.