-

- 02 JAN

After the markets were closed Monday for Christmas, the latest housing reports showed there’s broad-based home price appreciation around the country while sales are expected to pick up this year. Here are the highlights:

Home Sales “Will Improve in 2024” Home Prices Continue Higher Continuing Unemployment Claims Near 2-year High

Home Sales “Will Improve in 2024”

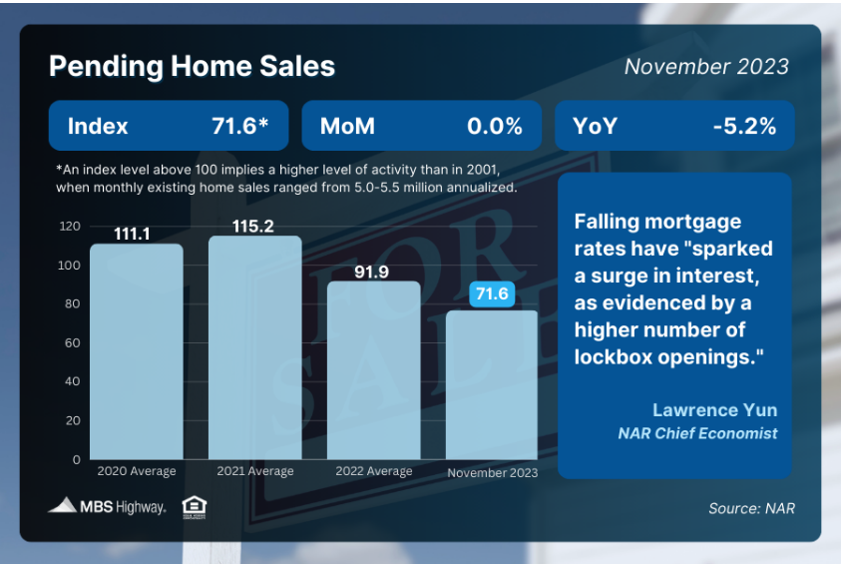

Pending Home Sales were unchanged from October to November, though October’s figures were revised slightly higher according to the National Association of REALTORS® (NAR). Sales were also 5.2% below the level reported in November of 2022. This data measures signed contracts on existing homes, making it a forward-looking indicator for closings as measured by Existing Home Sales.

What’s the bottom line?Though signed contracts were flat from October to November, declining mortgage rates have “sparked a surge in interest, as evidenced by a higher number of lockbox openings,” per NAR’s Chief Economist, Lawrence Yun. Yun added that sales are expected to improve in 2024, as lower rates have led “to savings of around $300 per month from the recent cyclical peak in rates.”

Home Prices Continue Higher

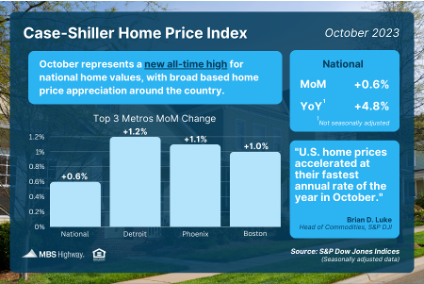

The Case-Shiller Home Price Index showed home prices nationwide rose 0.6% from September to October after seasonal adjustment, marking the ninth consecutive month of gains. Prices were also 4.8% higher than in October of last year. S&P DJI’s Head of Commodities, Brian D. Luke, noted that the report “reflects a rising tide across nearly all markets.”

The Federal Housing Finance Agency’s (FHFA) House Price Index also saw home prices rise 0.3% in October, with their index setting new record highs in home prices every month since February.

Note that FHFA’s report measures home price appreciation on single-family homes with conforming loan amounts, which means it most likely represents lower-priced homes. FHFA also does not include cash buyers or jumbo loans, and these factors account for some of the differences in the two reports.

What’s the bottom line? Home prices continue to set new highs according to Case-Shiller, FHFA, CoreLogic and Black Knight, more than recovering from the downturn we saw in the second half of 2022.

Continuing Unemployment Claims Near 2-year High

Initial Jobless Claims rose by 12,000 in the latest week, with a higher-than-expected 218,000 people filing for unemployment benefits for the first time. Continuing Claims also rose by 14,000, remaining near the highest level in more than two years as 1,875,000 people are still receiving benefits after filing their initial claim.

What’s the bottom line? The low number of Initial Jobless Claims suggests that layoffs remain muted as employers are trying to hold on to workers. Yet, Continuing Claims have been trending higher and point to a weakening labor market, where it’s much harder for people to find employment once they are let go. Note that this data may be volatile in the coming weeks due to the Christmas and New Year holidays.

What to Look for This Week

After the market closures Monday for the New Year’s holiday, labor sector data will be plentiful. On Wednesday, look for the JOLTS (job openings) report for November while December’s ADP Employment Report (which measures private payrolls) and the latest Jobless Claims will be reported on Thursday. Friday brings December’s Jobs Report from the Bureau of Labor Statistics, which includes Non-farm Payrolls and the Unemployment Rate.

Technical Picture

In a recent Substack post, I offered my insight and analysis as to why I believe Mortgage Rates are likely to give back some of their recent improvements in the days and weeks to come.

“After making a high of nearly 5% on October 23rd, the yield on the 10-year broke below 3.8%. Incredible. The somewhat surprising “Fed Pivot” in early December only added to an already impressive move higher in bonds. Bonds have since moved from extremely oversold to extremely overbought. This begs the question, has the market misinterpreted, or over-interpreted the Fed’s message? Or, a less popular opinion, is the market leading the Fed, seeing economic challenges in the year ahead?” ...

You can read my latest Substack post HERE.

I am sticking to my LOCKING BIAS as we head into the first week of 2024. Not only are the first few weeks of the year historically volatile for the bond market but we’ll see the Fed minutes from their December meeting this week. Talk about being priced for perfection!

* Specific loan program availability and requirements may vary. Please get in touch with your mortgage advisor for more information.